Have you got a little side hustle selling your pre-loved items online? Maybe you do monthly clear-outs to make some room in your closet? Or even pass on your bits and bobs you now longer use or wear anymore to save a little holiday fund plot?

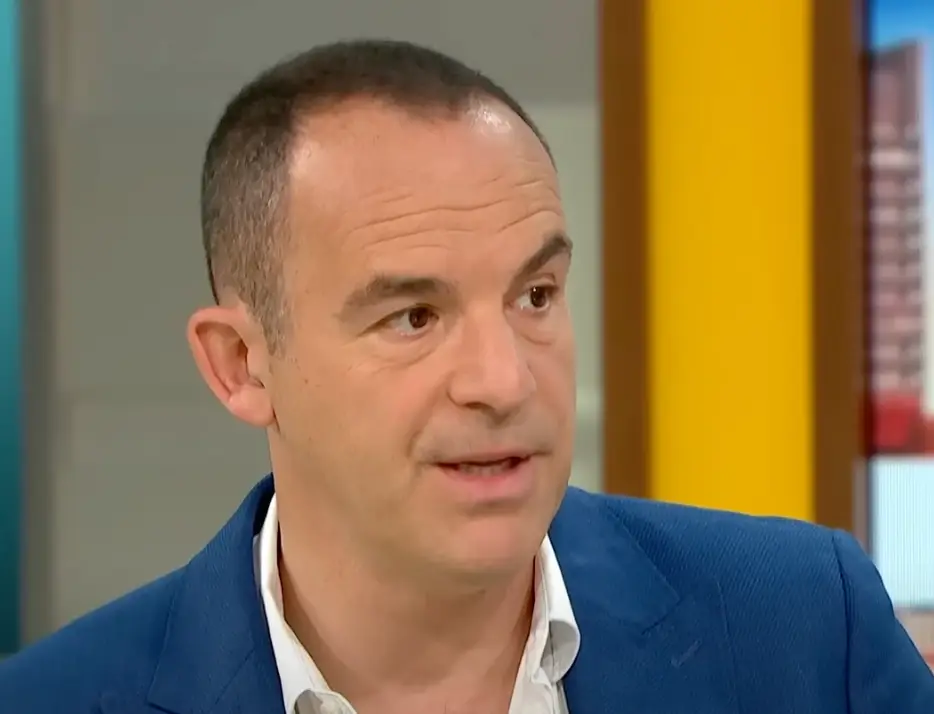

Well, you may want to listen up as Martin Lewis has issued an urgent warning to Vinted users after new rules were introduced to the selling platform by the government.

The Money Saving Expert took to X, formerly Twitter, earlier this week to share his advice for anyone who has an eBay, Etsy, Vinted or Airbnb account.

Advert

On Wednesday (3 January), Lewis warned his 2.5 million followers: "Sell on eBay, Etsy or Vinted or rent your home on Airbnb?

"Firms will now report some earnings to HMRC, so check if yours will be and if you need to pay tax."

In a follow-up tweet, the financial guru added: "Pls share. Many are worried after reports that Etsy, eBay, Vinted etc will start automatically passing sales info to HM Revenue."

Along with the tweet, the financial guru shared a link to an article on the Money Saving Expert website.

It reads: "If you sell goods online on sites such as eBay, Etsy or Vinted, rent out your home on Airbnb, or earn extra income from providing services via platforms including Deliveroo or Uber, then these firms will soon start passing on information about you to HM Revenue & Customs (HMRC).

"This means it's vital to check if you need to declare your income through self-assessment and possibly pay tax on it."

Starting on Monday (1 January), the 'digital platforms' now have to collect extra information about sellers, including how many sales they've made and how much income they've generated.

The website continues: "The platforms will have to start automatically sharing this information with HMRC by 31 January 2025 – the first lot of data-sharing will cover the current 2023/24 tax year, which is why it's worth getting on top of it now."

Previously, HMRC was able to access sellers' information from UK-based online platforms when required.

The new, automatic data-sharing process, which also covers overseas platforms, is being implemented after the UK signed up to rules by the international Organisation for Economic Co-operation and Development, which aim to tackle tax evasion globally, MSE explains.

To 'set your mind at rest', Lewis went on to summarise the three key points made in the article.

They read: "1. There is no new tax. 2. Unless you're 'trading' selling your old stuff isn't taxed. 3. Only sales over £1,700 or more than 30 items a year are reported."

"If the total amount you earn via a platform in a tax year is ABOVE £1,000, you LIKELY need to tell HMRC and MAY have to pay tax on this."

Topics: Fashion, Martin Lewis, Money, News, Shopping, Style, UK News, Vinted