California billionaires could have to dig deep and fork out a one-time tax of five percent of their total wealth - and it's reportedly causing some of them to flee the state.

Although it's still in early stages, the controversial proposed 2026 Billionaire Tax Act could appear on the sunshine state's November 2026 ballot, imposing a hefty onetime tax on its wealthiest residents.

It would hand a five percent tax payment on individual who have fortunes exceeding $1 billion, payable across five years, and would be applied retroactively to residents who were in the state as of this past New Year's Day (1 January, 2026).

The proposal is still in the beginning stages of gathering the 900,000 signatures needed for it to go to voters in November.

Advert

If approved by voters in a November ballot, it's set to raise an estimated $100 billion 'to prevent the collapse of California healthcare and ensure our state’s families can get the care we need', as per the tax act's website.

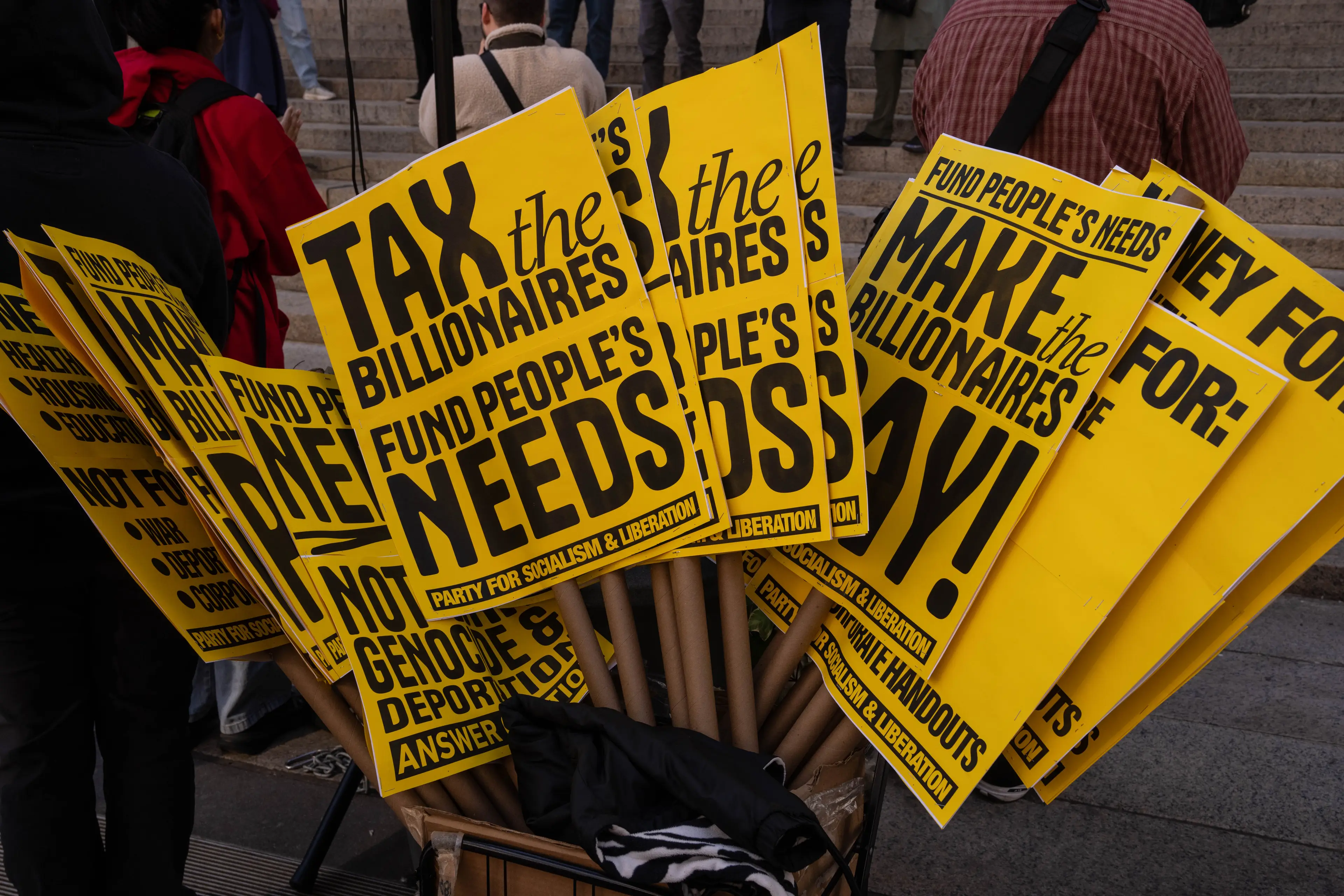

Those lobbying for it, penned: "The billionaire tax is a commonsense solution to a looming crisis and will help our state build a strong middle class."

They outlined that the group they're targeting is 'about 200 people who together hold $2 trillion in wealth, most of which, they claim 'will never be taxed in their lifetimes due to loopholes in state and federal tax laws'.

The $100bn the group hope to raise will 'replace lost federal dollars and protect essential services' and directs '90 percent of funds to healthcare and 10 percent to public K-14 education and state food assistance programs'.

As the website stresses, there will be no new taxes on the middle class, small businesses, or homeowners - this affects billionaires only.

It's a response to the federal healthcare cuts included in HR1, a budget reconciliation bill passed by Congress that significantly reduces Medicaid and other federal healthcare funding beginning in 2026.

The Service Employees International Union-United Healthcare Workers West, who are backing the bill, said the proposed start date was to ensure that the billionaires 'can’t avoid responsibility by moving their assets or claiming residency elsewhere'.

However, the plan has somewhat backfired as, according to Bloomberg, at least a half-dozen billionaires left California before the new year.

Peter Thiel and David Sacks both publicly announced new office locations on New Year’s Eve as they respectively departed for Florida and Texas, the publication reports.

For those unfamiliar, Thiel is a German-American entrepreneur, who's the co-founder of both PayPal and Palantir Technologies. According to Forbes, his net worth is roughly $26.1 billion.

Meanwhile, Sacks is a co-founder and partner at Craft, as well as an author, and investor in internet technology firms - his net worth is also reported to be in the billions.

And as per The New York Post, Google co-founder Larry Page had more than 45 California LLCs (Limited Liability Companies) tied to him recently file to go inactive or relocate out of state.

The publication also reports that a trust linked to Page bought a $101.5 million waterfront estate and another $71.9 million mansion in Miami’s Coconut Grove.

However, not every billionaire is upping sticks as Jensen Huang, the CEO of Nvidia, told Bloomberg Television this week that he is actually 'perfectly fine with it'.

He said: "We chose to live in Silicon Valley. And whatever taxes I guess they would like to apply, so be it."

Topics: US News, World News, News, Money, Politics