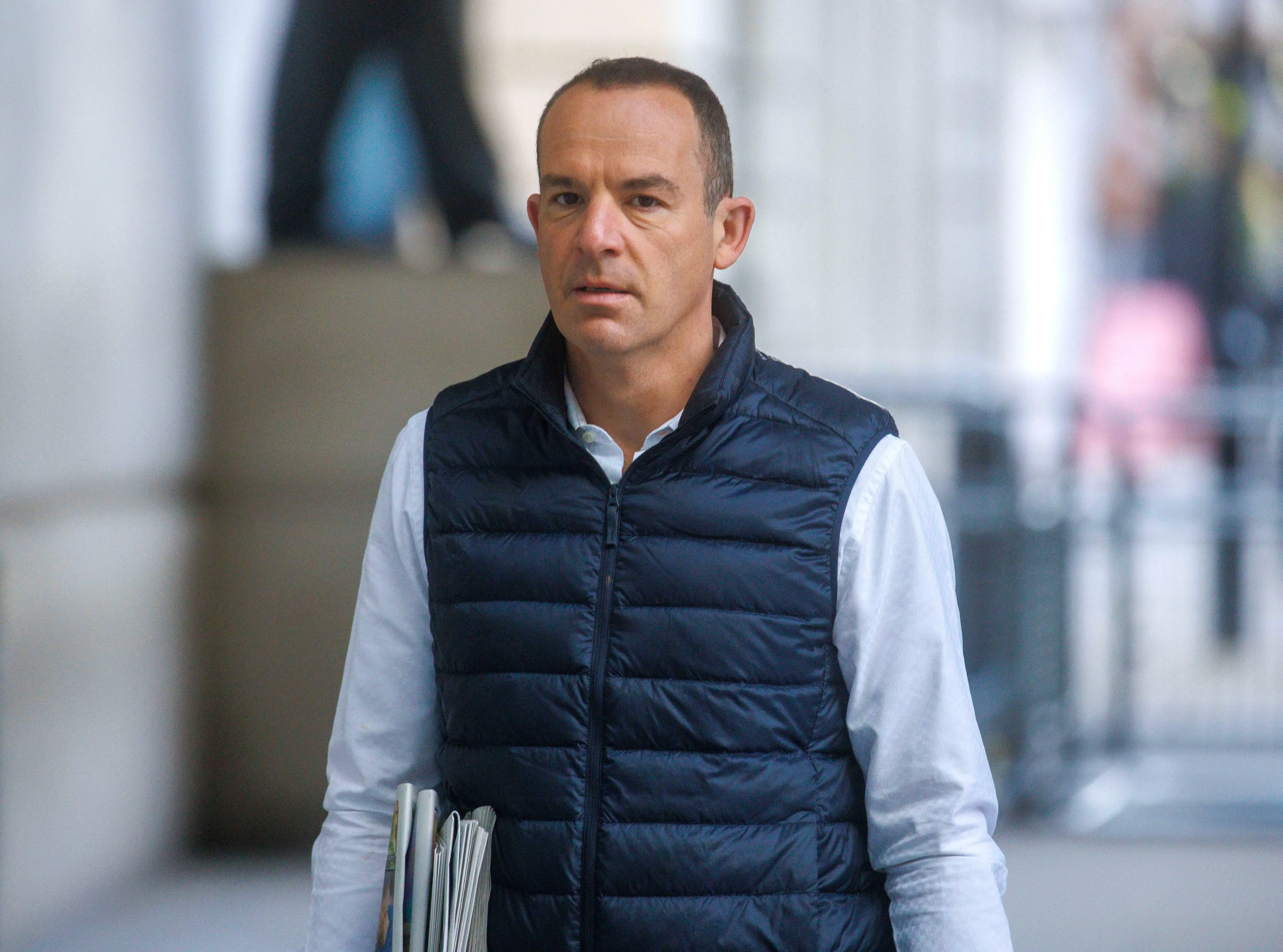

Martin Lewis has issued a warning to Brits with a mortgage.

The founder of Money Saving Expert shared a tweet explaining how the Bank of England has raised interest rates from 0.75 per cent to 1 per cent - which is the highest it’s been in 13 years.

Marking the fourth consecutive rise in interest since December, this base rate is used by banks to decide how much they charge when you borrow money, including on a mortgage, as well as how much you receive on your savings.

Advert

Now, following the interest rate rise, Martin has warned UK residents about the information to take home regarding their mortgages.

In a news story written by Emily White on the site, the money-saving expert explained that even though the rates have increased, most mortgage holders in the UK have a fixed-rate mortgage and won’t see anything changing.

However, if your mortgage deal is coming to an end, they suggest that organising a new deal as soon as possible is a good start. Getting a fixed rate deal means that the amount you pay won’t change during this fixed period.

Furthermore, it’s possible that lenders may raise the standard variable rate (SVR) or ‘discount’ mortgages in line with the increased interest rate. However these rates are controlled by lenders, so it’s not set in stone.

Most mortgage-holders will be placed on an SVR after a fixed-rate plan ends, with a ‘discount’ mortgage following the SVR at a set rate. MoneySavingExpert explained: “If the SVR is 4 per cent and the rate is SVR minus one percentage point, it's 3 per cent.”

Meanwhile, a tracker mortgage will see rates increasing, as this type of loan ‘tracks’ the base rate, which is currently rising. They explained how “this latest rise means about an £11 increase in your monthly payments on a £100,000 mortgage.”

A representative of the Bank of England previously told the Mirror: "We expect inflation to rise further to around 10 per cent this year.

"Prices are likely to rise faster than income for many people. That means that people will be able to buy less with their money."

Topics: Life, Martin Lewis, Money, Home