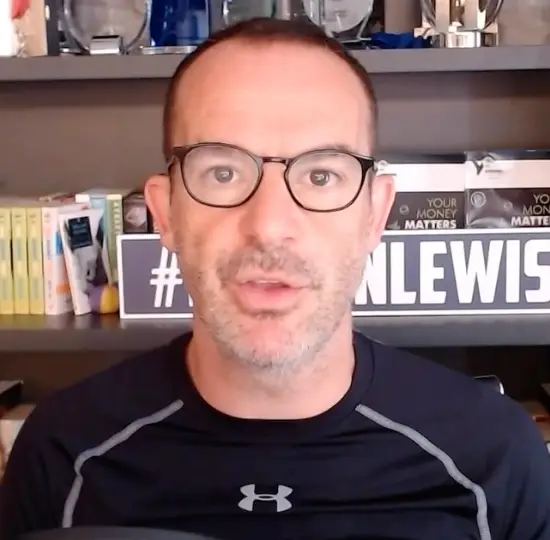

Martin Lewis has explained a huge change in child benefits ahead of this year's spring budget.

Earlier today (6 March), Chancellor of the Exchequer Jeremy Hunt confirmed the Child Benefit threshold was increased from £50k to £60k - meaning nobody earning under will pay the charge.

Hunt added: "We will raise the top of the taper of which it's withdrawn to £80,000.

Advert

"That means no one earning under £60,000 will pay the charge, taking 170,000 families out of paying it altogether."

Elsewhere in his speech, Hunt explained that he will consult on a new rule to make the benefit to apply to collective household income, rather than on an individual basis.

He said he will aim to introduce this by April 2026.

Hunt stated: "A year ago I announced the biggest ever extension of childcare, extending free childcare for all children over nine months.

"I am today guaranteeing rates for childcare providers to deliver the landmark offer."

However, with that said, Martin added: "He doesn't say the rates though, so we don't know if it'll be enough for childcare providers."

The Money Saving Expert took to X, formerly Twitter, to announce the news to his 2.7 million followers.

He penned: "WE GOT THE WIN ON CHILD BENEFIT!

"Chancellor tipped me off before budget, said this was due in large to MSE/my shows campaigning all based on all those of your who messaged me to say it was the key thing to put to him."

Martin then explained: "So 1) From this April threshold which hasn't moved since 2013 rises from a single parent earning £50,000 to £60,000 and you lose child benefit totally at £80,000 (not £60,000).

"2) Consultation on moving it to family income not individual income and hopefully that'll be in place from April 2026 (this is to stop unfairness for single income/single parent) families."

People couldn't wait to share their reactions to the news, with one X user writing: "Absolutely needs to be a family income, as a single parent I'm currently hit with a 61% effective tax rate and this stands to jump to 81% as a blended family with 4 children."

Another penned: "I hope so, my partner doesn’t work due to costs of child care outweighing her salary for two young children, this could take some pressure off."

Hunt also announced that National Insurance (NI) was to be slashed by two pence.

NI will now fall from 10 percent to eight percent of your wage every month, which is significant in regards to excess income.

The cut will happen in April 2024.

To put it simply, this will put around £450 back in to our pockets if you work for an employer rather than being self-employed; roughly £37.50 extra in every monthly pay packet.

Topics: News, UK News, Politics, Money, Parenting, Cost of Living, Martin Lewis