Martin Lewis has issued a stark warning to UK couples who could be missing out on thousands of pounds.

The Money Saving Expert shared the vital advice on the most recent episode of his ITV show yesterday (13 March).

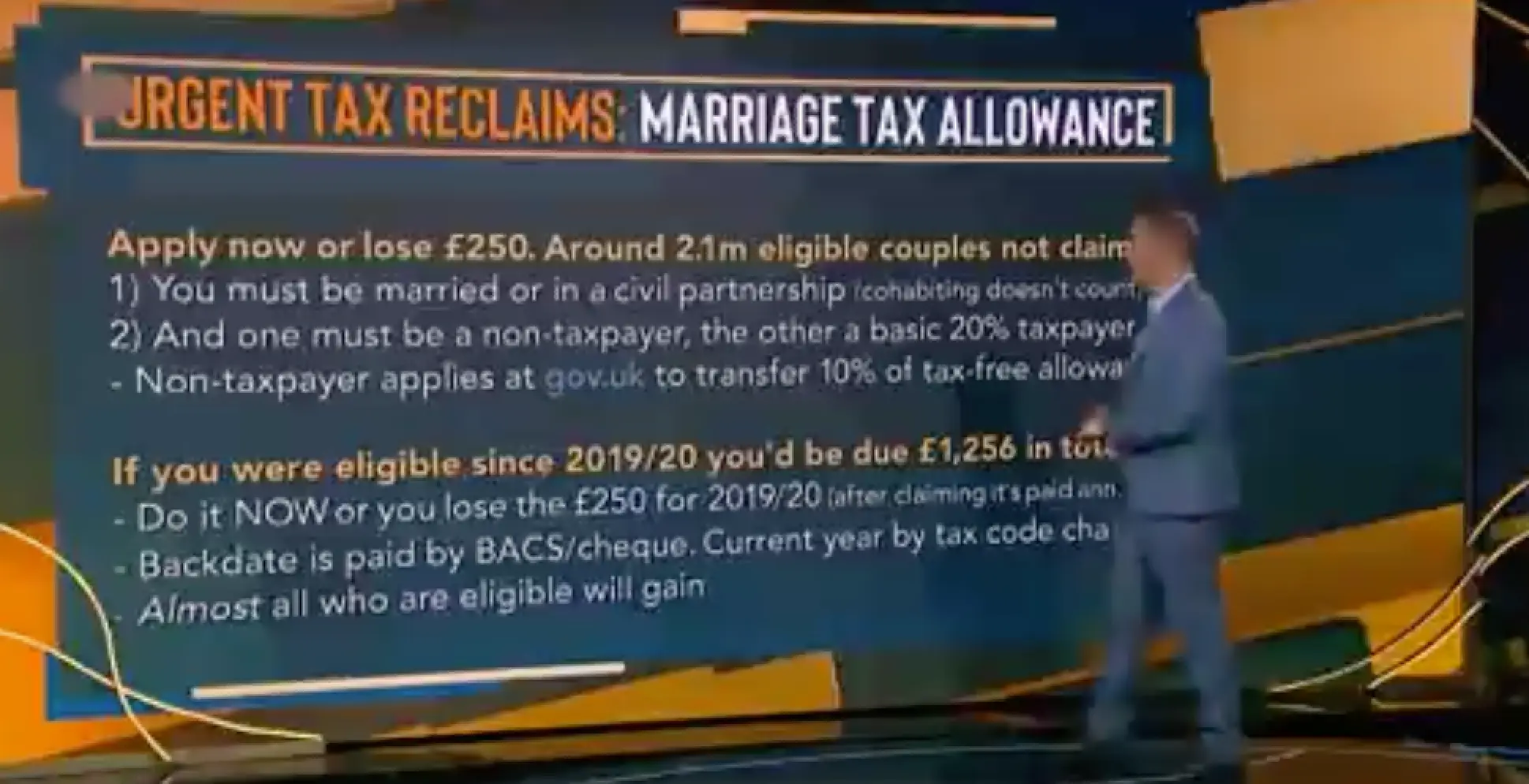

The financial guru warned that a colossal 2.1 million couples across the country could be entitled to 'big money' yet are not currently claiming it. Have a look:

Advert

Lewis has since shared a snippet from the segment to his 2.7 million followers on X, formerly Twitter, with the caption: "Are you married? If so you may be due an urgent £1,256 tax back…"

In the clip, he explained: "There are around a staggering 2,100,000 couples out there who are eligible for this, it is big money and are not claiming it."

He then mapped out the 'two criteria' you would need to qualify for the payment.

"First of all, you must be married or in a civil partnership, I'm afraid just cohabiting does not count, and one of you must be a non-taxpayer - so that's usually earning under £12,570 a year, and the other one a 20 percent taxpayer so that's usually - depending where in the UK you are - earning between £12,500 to £50,000 pounds a year.

"If so, the non taxpayer applies at Gov.uk to transfer 10 percent of their tax free allowance."

He continued: "The non-taxpayer and the 20 percent taxpayer can both earn £12,570 per tax year, tax free.

"So this is what happens, you get 10 percent of that, which is £1,260 and the non-taxpayer can apply to give it to their spouse.

"So now the non-taxpayer, while they're not earning that amount, so it doesn't really matter, they can't earn as much, but the taxpayer has an extra 20 percent, at which they are not taxed.

"So 20% of the extra amount of £1,260 means they gain £250 quid a year and they get a higher tax-free allowance.

"And that, in simple terms, is how the marriage tax allowance works, you just transfer it across."

Lewis then explained what the 'really important thing' was, adding: "If you were eligible for this, since 2019/20, you would be due a total of £1,256 if you claim back, you need to do it now or you lose the £250 for that 2019/20 tax year."

He did make sure to also note: "Once you claim, it's then paid automatically year after year although you have to declare if you're no longer eligible for it."

Topics: Cost of Living, Martin Lewis, Money, News, UK News, ITV, TV And Film, Hacks, Advice, Sex and Relationships