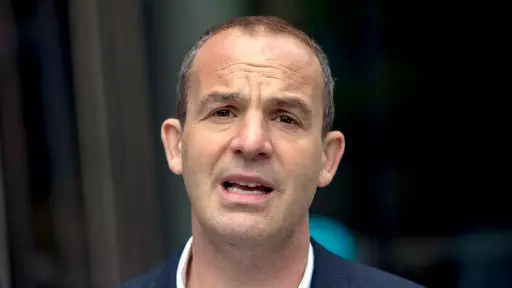

Martin Lewis has saved us a lot of cash over the years - and he's at it again, as he's just sent out a very useful reminder which will help many of us save up to £125 on tax this year.

Remember last year when we told you about the tax break you could get if you've worked from home even one day over lockdown?

Well, the Money Saving Expert has advised that the same relief applies again, and it's available from HM Revenue and Customs (HMRC) if your employer has asked you to work at home at all this year, as a consequence of coronavirus.

Advert

HMRC confirmed that employees can claim tax relief based on the rate of tax they pay - which works out at £62 a year for basic rate taxpayers and £124 a year at the higher rate.

The tax relief doesn't count if you've worked from home purely by choice, but given that we started the year in lockdown, it's likely it will apply to most of us who have the capacity to work from home, based on government guidelines.

Speaking on the Martin Lewis Money Show Live, the TV favourite confirmed the tax break was going ahead for this financial year too.

Advert

"There are working from home benefits available if you've had extra costs such as more heating or electricity as is common," he said.

"You can either ask your employer for £6 a week tax free - but many employers aren't doing that though. If they're not you're entitled to £6 a week, tax free relief, so £6 of your salary that would be taxed, isn't taxed."

"If you want to ask for more because you have more expenses, you're going to need proof," he went on.

The additional costs this money covers includes heating, home contents insurance, business calls, metered water bills and a new broadband connection, if necessary.

Advert

It doesn't cover costs that would stay the same regardless, such as council tax, rent or mortgage interest.

So, let's break it down:

HMRC have said you can claim tax relief if you've worked from home even one day and it was advised by your employer.

Advert

You can either claim:

- £6 a week starting from April 6th, (for previous tax years the rate is £4 a week). For this, you will not need any evidence of your extra costs.

- OR the exact amount of extra costs if they surpass this weekly amount (but only if you have evidence such as receipts, contracts or relevant bills).

Those paying the tax rate 20 per cent (which is standard) can claim £1.20 per week in tax from that £6 cost, meanwhile those paying the higher tax rate of 40 per cent will be able to claim £2.40 per week.

If you pay 45 per cent additional rate tax you can claim back as much as £2.70 a week.

To claim your money back, you can apply in exactly the same way as last year.

Advert

"You do it by going to the GOV.UK micro service, you'll automatically get it for the whole year, the tax relief is worth £62 a year for a basic rate taxpayer," Martin said.

"Now, this applies if you've been working from home for one day, you can get the whole year's relief as long as it was required," he said.

"Originally, this was a Covid provision only for the last tax year 2020/21. But just before the new tax year started, which is only about a month ago, we learned that now works for 2021/22 as well.

"So if you work from home for one day this tax year too, you can get the whole year's allowance."

The good news is that those who didn't claim the tax break last year can still do so, too.

"If you've not applied, you can apply for last year in this year, as long as you work from home for at least a day and were required to.

"If you've already applied, you can apply again," Martin explained. "So, that's £124 for the two years, more if you're a high rate taxpayer.

"[It's] done by changing your tax cost like marriage tax allowances, although for last year you'll probably get a cheque back."

People who do tax self assessment will have to apply manually by their tax returns and won't be able to use the micro service.

While the idea of a refund sounds great, it's not going to land straight in your bank account. Instead, your tax code is tweaked so that slightly less money is taken from your pay packet.

Essentially, this means more money in your pocket - although, of course, the idea is that this cash helps towards your WFH expenses...

Still, this is so worth knowing!

Featured Image Credit: PATopics: Martin Lewis, TV News, Money